new mexico solar tax credit 2020 form

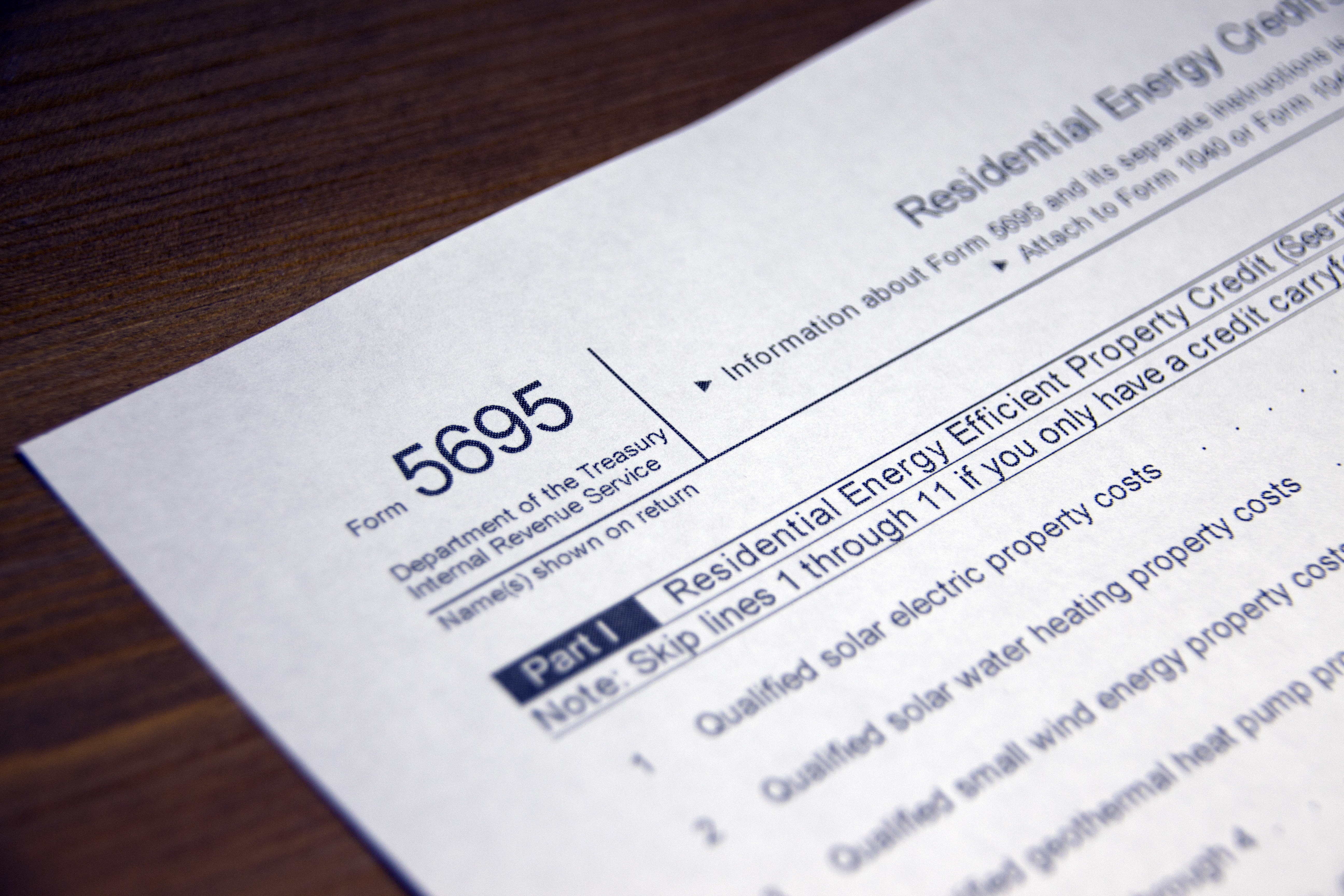

The wait is over. Form 5695 calculates tax credits for a variety of qualified residential energy improvements including geothermal heat pumps solar panels solar water heating small wind turbines and fuel cells.

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

Enter your energy efficiency property costs.

. Buy and install new solar panels in New Mexico in 2021 with or without a home battery and qualify for the 26 federal solar tax credit. Every installation owner is encouraged to submit an application to the office as soon as their system is fully connected and operational. New Mexicos popular solar tax credit scheme that previously aided about 7000 residents is brought into action again.

It provides a 10 tax credit with a value up. Well use 25000 gross cost of a solar energy system as an example. Each year after it will decrease at a rate of 10 per year.

The bill states that a business or homeowner who purchases and installs a solar energy system on or after March 1 2020 are eligible for this non-refundable tax credit. For assistance see the New Solar Market Development Income Tax rule 3314 NMAC for personal income taxes or 3421 NMAC for corporate income taxes and other information available at the Clean Energy. New Mexico provides a number of tax credits and rebates for New Mexico individual income tax filers.

09132016 To complete Section II of the claim Form RPD-41227 Renewable Energy Production Tax Credit Claim Form attach a com - pleted Schedule A to compute unused credits for carry forward from prior tax year claims. The balance of any refundable credits after paying all taxes due is refunded to you. New Mexico state tax credit.

After it expired in 2016 New Mexicos governor Michelle Lujan Grisham signed the New Solar Market Development Tax. Download This Form Print This Form We last updated the Solar Market Development Income Tax Credit Claim F in April 2021 and the latest form we have available is for tax year 2020. The residential ITC drops to 22 in 2023 and ends in 2024.

The tax credit applies to residential commercial and agricultural installations. There is a cap of 8 million in tax credits to be issued every year on a first-come first-serve basis. The starting date for this tax credit is March 1 2020 and the tax credit runs through December 31 2027.

In a disappointment to the solar industry the Congressional bill did not include a provision that. We last updated the Advanced Energy Tax Credit Claim Form in April 2021 and the latest form we have available is for tax year 2020. And Be certified by the New Mexico Energy Minerals and Natural Resources Department.

Obviously there are many incentives to go solar such as the benefits provided by the New Mexico solar tax credit but truly solar can be viewed as an. First come first served - the solar tax credit has an annual allotment of 8M. The New Solar Market Development Income Tax Credit was passed by the 2020 New Mexico Legislature.

The state tax credit is equal to 10 of the total installation costs of your solar system up to 6000 per taxpayer per taxable year. New Mexico state solar tax credit. In order to be eligible for the incentive your solar system must.

Click New Solar Market Development Continue Enter up to three credit certificates and the amount of credit applied to tax. The credit is applicable for up to 8 years starting in 2020. In December 2020 Congress passed an extension of the ITC which provides a 26 tax credit for systems installed in 2020-2022 and 22 for systems installed in 2023.

The federal solar tax credit. Who is eligible for the New Mexico solar tax credit. Be installed on or after March 1 2020.

SOLAR MARKET DEVELOPMENT TAX CREDIT CLAIM FORM Enter the credit claimed on the tax credit schedule PIT-CR or FID-CR for the personal income tax return Form PIT-1 or the fiduciary income tax return Form FID-1. For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. So the ITC will be 20 in 2020 and 10 in 2021.

The maximum tax credit per taxpayer per year. See form PIT-RC Rebate and Credit Schedule. In order to facilitate the adoption of clean energy the Federal Solar Tax Credit or the Federal Investment Tax Credit ITC was initiated.

Upload Application Please review the above list before you upload your documentation to make sure youve completed all forms required in the tax credit application package. The tax credit is up to 10 of the purchase and installation of the solar panels. Please use the link below to download 2020-new-mexico-form-rpd-41317pdf and you can print it directly from your computer.

This tax credit is based upon ten percent of the solar system value and is available for solar thermal and photovol taic solar systems. This means that we dont yet have the updated form for the current tax yearPlease check this page regularly as we will post the updated form as soon as it is released by the New Mexico Taxation and Revenue Department. It covers 10 of your installation costs up to a maximum of 6000.

Form and Submittal Instructions. The Residential Solar Investment Tax Credit ITC of the total cost of solar installation goes until 2019 at 30. It is taken in the tax year that you complete your solar install.

Youll find this credit in Business Credits within the New Mexico portion of TurboTax. Systems installed before December 31 2019 were eligible for a 30 tax credit The tax credit expires starting in 2024 unless Congress renews it. 12790 Approximate system cost in NM after the 26 ITC in 2021.

This bill re -started the popular residential solar tax credit program. The new solar market development tax credit may be claimed by a taxpayer who files a New Mexico personal or fiduciary income tax return for a tax year beginning on or after January 1 2020 and has purchased and installed a qualified photovoltaic. The solar market development tax credit may be deducted only from the taxpayers New Mexico personal or fiduciary income tax liability.

A Were the qualified energy efficiency improvements or residential energy property costs for your main home located in the United States. The PIT-RC Rebate and Credit Schedule is a separate schedule to claim refundable credits. In 2020 New Mexico lawmakers passed a statewide solar tax credit called the New Solar Market Development Income Tax Credit.

Average-sized 5-kilowatt kW system cost in New Mexico. This incentive can reduce your state tax payments by up to 6000 or 10 off your total solar energy expenses whichever is lower. The Solar ITC is one of the greatest and most popular New Mexico solar panels installation incentives which offer a certain percentage.

The New Mexico State Legislature passed Senate Bill 29 in early 2020. The new law is applicable to tax years starting on January 1 2020. State of New Mexico - Taxation Revenue Department SOLAR MARKET DEVELOPMENT TAX CREDIT CLAIM FORM Schedule A You must attach Schedule A with Form RPD-41317 Solar Market Development Tax Credit Claim Form.

Applications are not currently available on the Departments website. See below for forms. Since most average sized 6kW systems cost about 18000 you can expect a credit of about 1800.

The credit is capped at 6000. The federal credit is in addition to New Mexicos solar state tax credit which was reinstated in March 2020. This bill provides a 10 tax credit with a savings value up to 6000 for a solar energy systems.

Why Should You Go Solar. The bill was passed during the George Bush administration through the Energy Policy Act of 2005.

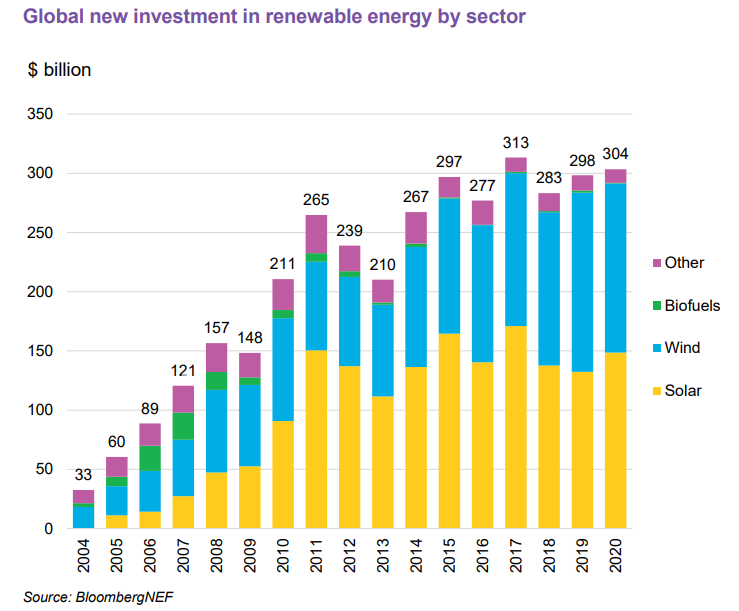

Bnef Up To 194gw Of Solar Could Be Installed In 2021 As Investments Soar Pv Tech

The Solar Investment Tax Credit Why It S Time To Switch

Bnef Up To 194gw Of Solar Could Be Installed In 2021 As Investments Soar Pv Tech

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

Inside Energy December 2020 By Energy Industries Council Issuu

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

Chapter 1 What Is The Best Policy Instrument For Reducing Co2 Emissions In Fiscal Policy To Mitigate Climate Change

Global Ocean Science Report 2020 Charting Capacity For Ocean Sustainability

Solar And Battery Storage Videos Panasonic North America United States

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

The Cost Of Capital In Clean Energy Transitions Analysis Iea